CFD - Commission

CFD trading has commission to open and to close a trade and the commission is deducted from Account Balance at the moment of opening the position.

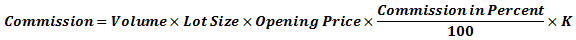

The commission for trades on commodities (XBRUSD, XTIUSD, XNGUSD) is calculated using the following formula:

where:

- Volume — volume of position in lots;

- Lot Size — number of ounces, barrels or commodity units in one lot;

- Opening Price — position’s opening price;

- Commission in Percent — commission in percent charged per 1 lot;

- K — Profit Currency (second currency in the symbol) to Deposit Currency conversion rate.

Example:

- Trade: XTIUSD (US Crude Oil)

- Deposit Currency: USD

- Profit Currency: USD

- Conversion Rate: 1

- Commission in Percent: 0.005

- Commission mode: round turn

- Opening Price: 47.17

- Volume: 2 lots

- Lot Size: 1000

Commission rounded: 4.72 (USD)

The commission for trades on indices is calculated using the following formula:

where:

- Volume — volume of position in lots;

- Lot Size — number of contracts in one lot;

- Commission in Percent — commission in percent charged per Trading Terms;

- K — Profit Currency (currency of the Index) to Deposit Currency conversion rate.

Example:

- Trade: #AUS200 (Australia 200)

- Deposit Currency: USD

- Profit Currency: AUD

- Conversion Rate: AUD/USD ask = 0.72585

- Commission in Percent: 0.005% (per one side)

- Commission mode: round turn (for opening and closing position)

- Opening Price: 7126.00

- Volume: 5 lots

- Lot Size: 10 Indices

Commission rounded: 25.86 (USD)

Related Articles

CFD - Commission

CFD trading has commission to open and to close a trade and the commission is deducted from Account Balance at the moment of opening the position. The commission for trades on commodities (XBRUSD, XTIUSD, XNGUSD) is calculated using the following ...CFD - Contract For Difference

Contract For Difference is an agreement (guarantee liability) between two parties on the payment of the difference between asset's current value and its value at the end of the agreement period. In fact, the parties conclude an asset buy/sell ...CFD - Contract For Difference

Contract For Difference is an agreement (guarantee liability) between two parties on the payment of the difference between asset's current value and its value at the end of the agreement period. In fact, the parties conclude an asset buy/sell ...CFD - Calculation of dividends when trading Stocks and ETFs CFDs

Deduction and accrual of dividends when trading Stocks CFDs and ETF CFDs A Contract for Difference (CFD) is a derivative instrument, underlying assets (stocks, indices) of which are traded on stock exchanges. When trading CFDs on a company's shares, ...CFD - Calculation of dividends when trading Stocks and ETFs CFDs

Deduction and accrual of dividends when trading Stocks CFDs and ETF CFDs A Contract for Difference (CFD) is a derivative instrument, underlying assets (stocks, indices) of which are traded on stock exchanges. When trading CFDs on a company's shares, ...